Fake AI Startup Exposed – Founder Charged

The venture market seems to be roaring back to life – but all is not as it appears. This week’s edition of The Venture Insider slices through the hype.

We’re unpacking a massive $650M moonshot in brain-tech, a founder fraud scandalstraight out of a movie, and why unicorn CEOs are finally swallowing their pride.

And in our Premium Analysis, we dig into the hidden cracks behind the VC funding “rebound” everyone’s buzzing about. There are surprises in the data that even savvy insiders might be missing.

Buckle up – today’s insights might just make you question the supposed startup comeback and give you an edge in navigating the noise.

📰 Trends & Headlines

Neuralink’s $650M Brain-Tech Bet: Elon Musk’s neurotech startup Neuralink just closed a whopping $650 million Series E to accelerate its brain-computer interface implantstechstartups.com. The company is pushing toward tech that lets paralyzed patients control devices with their thoughts, after already kicking off human trials. Why it matters: This is one of the year’s largest frontier-tech investments, signaling that even in a cautious market, investors will open the floodgates for bold, sci-fi bets. It’s a moonshot ambition (mind-controlled computing!) that could redefine assistive tech – and it shows Silicon Valley’s appetite for high-risk, high-reward innovation is alive and well.

Fake AI Startup Exposed – Founder Charged: In a saga that’s part drama, part cautionary tale, the founder of “AI-powered” shopping app Nate was charged by the DOJ with fraud for allegedly faking his techeconomictimes.indiatimes.com. He raised over $50M claiming a proprietary AI could automate online purchases – but in reality, he had human workers in a room doing the jobeconomictimes.indiatimes.com. Nate burned through the cash and collapsed, leaving investors with nearly nothing. Why it matters: The “fake it till you make it” ethos just hit a wall. In an era of AI hype, this is a stark reminder that not every “AI startup” is the real deal. Regulators are watching, and founders flirting with deception now face very real consequences (up to 20 years in prison in this case). Trust – the true currency of Silicon Valley – is on notice.

Unicorns Swallow Pride with Down-Round IPOs: After years of holding out, several billion-dollar startups are finally going public at much lower valuations than their peak – and the sky hasn’t fallen. Fintech giant Chime is seeking an IPO at barely half its 2021 valuation, and health techs Hinge Health and trading platform eToro both IPO’ed below their last private pricesaxios.com. Why it matters: This marks a sea change in startup-land. Instead of endlessly waiting to “grow into” sky-high valuations, founders are accepting reality – and being rewarded for itaxios.com. These newly humbled IPOs saw their stock prices pop post-listing (e.g. Hinge Health +26%, eToro +18% above IPO price)axios.com. It suggests the frozen exit market is finally thawing: by ripping off the band-aid and pricing sanely, startups can tap public markets and give VCs their long-awaited exits. The ego era is ending; a new wave of pragmatic, get-it-done public debuts is arriving.

💬 Spotted on Twitter (and LinkedIn)

Paul Graham’s Contrarian Playbook: Famed Y Combinator co-founder Paul Graham shared a surprisingly radical startup strategy for 2025 that goes against today’s growth-at-all-costs mentalitylinkedin.com. His advice? Raise modestly (just ~$500k), stay tiny, obsess over users, fly under the radar, and hit profitability before scalinglinkedin.com. In his words, “Ideally I’d get to profitability on that initial $500k… At every point in growth, I’d keep the company as small as possible”linkedin.com. Why it’s buzzworthy: In a world where founders chase ever-bigger raises and headcount, Graham’s call to do the opposite is lighting up conversations. Keeping teams lean and costs low isn’t just quaint nostalgia – it might be a competitive edge in a tight funding environment. Fewer employees means faster decisions and more runway to build something amazing without serving the ego of “how big is your team.” It’s a reminder that sometimes, focus > flash, and stealthily building a real business beats making noise.

📢 Venture Insider sponsors (by Subletter.io)

GummySearch

GummySearch is an AI-based Customer Research tool for Reddit. It allows you to systematically research what people are talking about, and how they feel about your competition and your industry.

You can use it to find pain points and solutions asking to be built, content ideas to create, or sales leads to connect with.

GummySearch is free to try, and the premium features can be purchased via a monthly subscription or a day pass (great for those doing one-off research sprints)

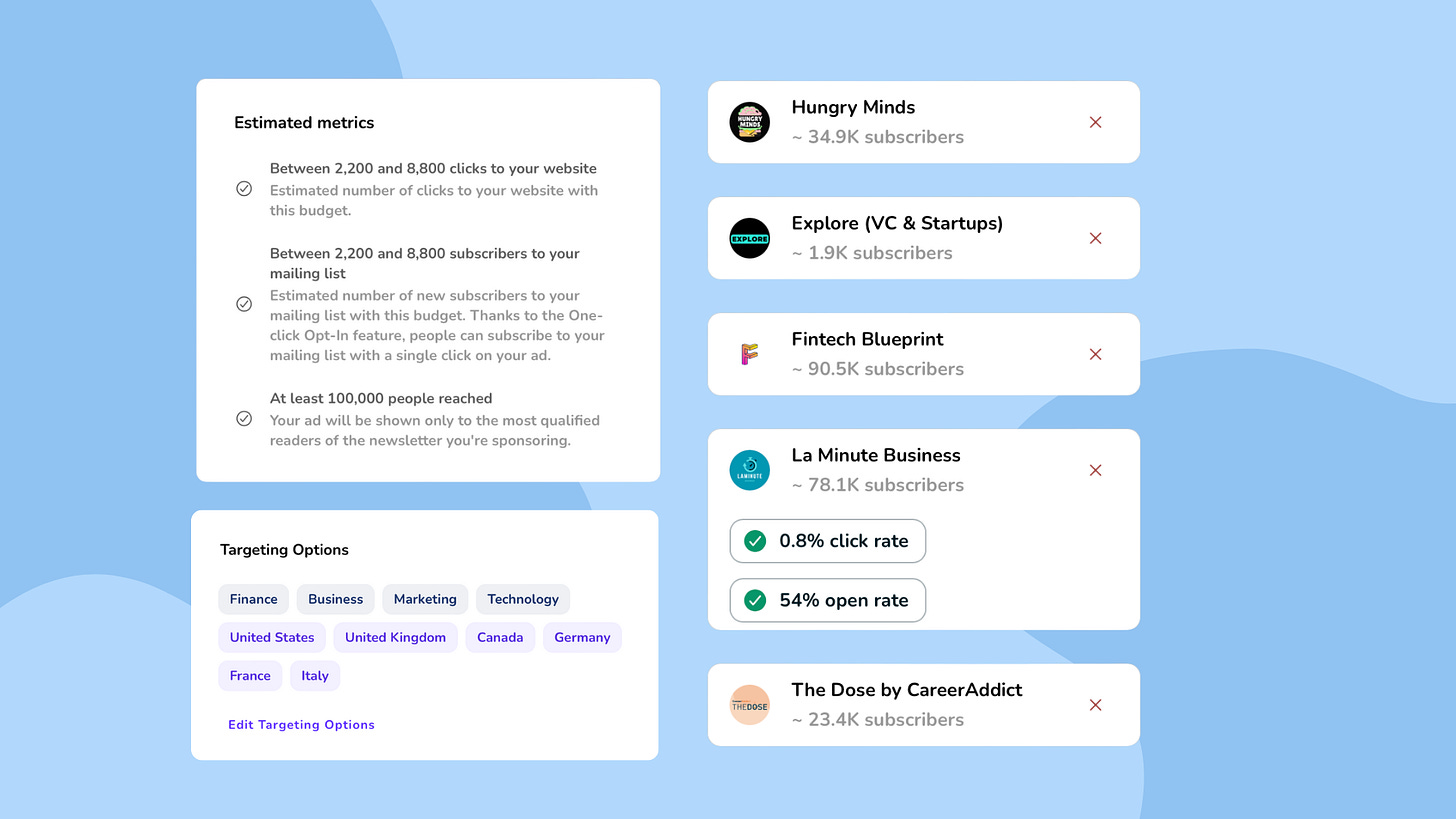

Sponsor 2,000 newsletters with Subletter.io - enjoy $2,000 credits

Sponsoring newsletters is one of the most effective ways to reach highly qualified, engaged audiences and drive serious growth for your business.

And Subletter is the most powerful platform to do it — allowing you to sponsor top-performing newsletters while only paying based on the results you get.

To celebrate our launch a few months ago, we rolled out an insane deal for new advertisers: you pay just $500, and we add $2,000 in bonus ad credits to your Subletter account. That gives you a total of $2,500 to sponsor the newsletters of your choice on the platform.

With that budget, you can run campaigns across some of the most-read newsletters in your industry — reaching audiences that collectively count hundreds of millions of subscribers.

And the best part? Your budget is only spent when people actually click through to your site.

If your goal is to generate leads, we also offer an Optins mode: you only pay for actual email subscribers. With our one-click opt-in feature, users can subscribe to your list directly from the ad — no landing page needed.

Thousands of businesses have already jumped in to supercharge their growth.

But we can only extend this offer to 500 advertisers — and we’re almost at capacity.

Once the spots are gone, it’s over. No extensions. No exceptions.

This is your chance to join.

👉 Claim your $2,000 in ad credits now

Don’t wait. Tomorrow will be too late.

Unlock Your Future in AI Engineering – Free Guide for Aspiring Innovators!

Discover the secrets of AI Engineering with our exclusive free guide designed for junior engineers!

Unpack the roles, tools, and real-world strategies to start building cutting-edge AI solutions today.

Join our community, gain actionable insights, and transform your career path in AI. Download now and step confidently into the future of technology!

🔎 Deep Dive / Premium Analysis

The Great VC Rebound… or a Great Mirage?

First, the teaser (free): It’s the comeback everyone in startup-land is talking about – venture funding soaring back in 2025 after a brutal slump.

Headlines boast that global VC investment just had its strongest quarter since 2022, and valuations for top startups are climbing to stratospheric levels again.

But behind that banner $113 billion in Q1 funding lies a far more polarized reality.

A handful of cash-guzzling giants are lifting the averages, while countless early-stage founders still feel like the funding winter never left.

In fact, one single mega-deal skewed the stats so much that without it, the “rebound” nearly vanishes.

In today’s Premium analysis, we unveil what’s really happeningbeneath the surface of the VC resurgence – and why savvy insiders are bracing for a possible aftershock.

To read the full breakdown, unlock Premium access.